ITC said it plans to add healthcare to its objects clause, but did not mention other details; so, could it be planning a full-fledged entry into the healthcare sector, either on its own or by acquiring an existing hospital chain? Photo: Bloomberg

The wait for ITC Ltd’s consumer business to become profitable has been a long one. While the business has grown in size, now at 18% of revenue, it continues to add new products in existing categories, enters new categories and invests behind them. That insatiable appetite to diversify revenue and grow scale indicates that profits will come later. This urge to diversify may now see it enter the healthcare sector.

ITC said it plans to add healthcare to its objects clause, but did not mention other details.

Could ITC be planning a full-fledged entry into the healthcare sector, either on its own or by acquiring an existing hospital chain?

Cigarettes and healthcare may make strange bedfellows, but hospitality and hotels do make for a good combination.

Also in common, unfortunately, is that setting up hospitals requires significant investments, especially if you have to add new ones, gestation periods are relatively long and the sector is becoming more competitive.

ITC’s recurring cash flows from the cigarettes business give it the requisite financial muscle, but investors may fret if the investment requirements prove to be substantial.

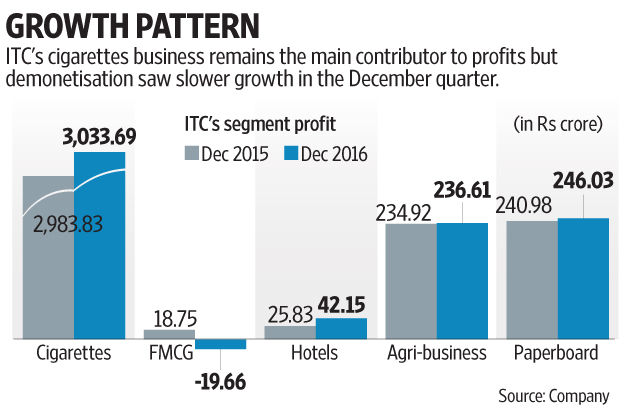

Coming to its results, demonetisation did see its cigarette sales growth slow down to 2.2% in the December quarter, compared with a growth of 7.1% in the September quarter.

It said that tight liquidity conditions affected sales growth. As the cash crunch eases, its cigarettes business should come back to more normal growth rates. The changes in tax rates in the budget, final rates and cess under goods and services tax, if any, on cigarettes, are near-term policy triggers to watch for.

Along with cigarettes, demonetisation did see its consumer business sales, too slow down to 3.4%. Hotels’ revenue growth was relatively better but paper saw a slight decline. Overall, net sales rose by 4.1% but a higher increase in material costs led to expenses rising by more than sales did. Its earnings before interest, taxes, depreciation and amortization (Ebitda) margin declined from over a year ago, as a result, but improved sequentially. Its profit after tax rose 5.7%. The cigarette segment’s margin declined and the consumer business turned in a loss of Rs19.7 crore.

ITC did better than what the Street was expecting. It should do even better as business improves, post-demonetisation. Still, the share fell 2.8% on Friday which may be partly due to it having rallied sharply since end-December (it is up 14% since 26 December). The diversification into healthcare, too, may have dampened investor enthusiasm. News on the taxation front and its plans for healthcare will occupy centre stage for the moment.

[“source-ndtv”]