In a surprise move, the board of Lakshmi Vilas Bank (LVB), a Tamil Nadu-based old private sector bank, approved a merger with Indiabulls Housing Finance (IBHF), the fourth largest housing finance company (HFC) in the country on April 5.

The share swap ratio has been fixed at 1:014, which implies that shareholders of LVB will be entitled to 14 shares of IBHF for every 100 shares of LVB. The ratio indicates a premium of around 35 percent (or price of Rs 125 per share) to LVB’s April 5 closing price of Rs 93 per share. However, the transaction will need approval from the Reserve Bank of India (RBI) and other regulatory authorities: National Housing Bank (NHB) and Securities and Exchange Board of India (SEBI).

There have been instances of merger between a bank and non- banking financial company (NBFC) in the past. The latest one being the merger of GRUH Finance with Bandhan Bank. Earlier instances include a merger of IDFC Bank and Capital First and acquisition of Bharat Financial Inclusion by IndusInd Bank.

- The deal between LVB and IBHF, however, is unique in a sense that it is not just a proposed merger announcement, but IBHF is essentially making a bid for a banking licence. This brings us to the moot question: will the merger and consequently a banking licence to IBHF get RBI’s approval?

IBHF is largely in compliance with the RBI’s August 2016 guidelines for ‘on tap’ licensing of universal banks in the private sector. For instance, RBI’s guidelines require that non-financial businesses of the group seeking a banking licence should not account for more than 40 percent of total assets or gross income.

Indiabulls more than satisfies this, as its real estate and other ventures don’t account for more than 15-20 percent of the group’s revenue. That said, there is an element of subjectivity in handing out banking licences by RBI, which adds a great deal of uncertainty to the deal. RBI’s intent to entrust banking licence only to groups with very high probity will as much drive its decision as an urge to extend a helping hand to a struggling weak bank.

The banking regulator has quickly made it clear that the merger announcement does not have its approval at this stage. It also clarified that the presence of additional directors nominated by RBI to the board of LVB does not imply any approval by it to the merger proposal. The additional directors have clearly mentioned at the board meeting that they have no view on the proposal. RBI will examine the proposals as and when it receives the same from LVB and IBHF.

While it is difficult to pre-empt the regulator’s response, let’s take a closer look at the contours of the deal, factors driving the move and implication for investors.

What’s the key motive behind the merger?

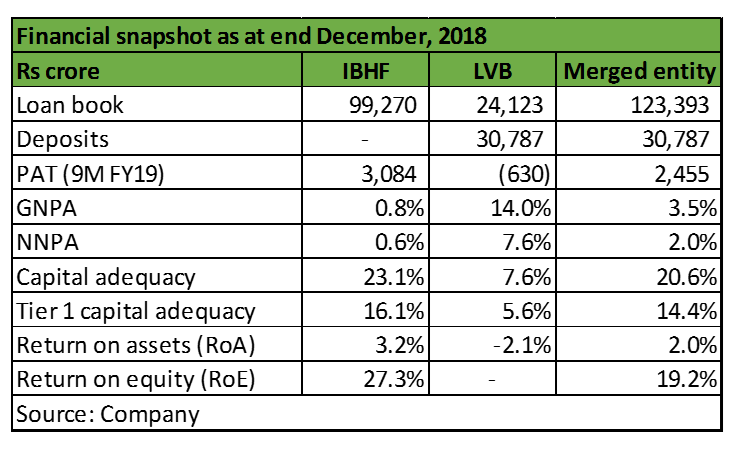

LVB had been reeling under the pressure of rising non-performing assets (gross NPAs) and dearth of adequate regulatory capital. It reported a loss of Rs 630 crore in the first nine months of FY19. Its capital adequacy ratio dropped to 7.57 percent and GNPA ratio surged to 13.95 percent at the end of December 2018. While the bank managed to raise Rs 460 crore through a qualified institutional placement (QIP) a few months back, it needed more capital to avoid a regulatory breach and falling under the Prompt Corrective Action (PCA) framework of RBI. The financial turmoil made it scout for a possible suitor and found one in IBHF.

As far as IBHF is concerned, it had tried earlier too, but failed to secure a banking licence from RBI in 2013.

The business models of NBFCs/HFCs have inherent limitation on growth in the absence of a stable liability franchise. This fact got further highlighted during the liquidity crisis that engulfed the NBFC sector since September last year. In the aftermath of the liquidity crisis, IBHF pared down its loan growth target and resorted to aggressive selling of its loan portfolio to manage liquidity.

By merging LVB with itself, IBHF is attempting a backdoor entry into the banking sector, which will provide it stable low-cost funding in the form of public deposits and an expanded distribution franchise.

Contours of the deal

The merger if approved would create one of largest private bank (within top 8) in the country, with 800 branches and loan book of around Rs 1,20,000 crore.

Promoters stake/holding in IBHF will reduce from the current 21.5 percent to 19.5 percent on completion of the merger. The promoter also expressed willingness to further pare down the stake to 15 percent before the implementation of merger to comply with RBI’s new bank licencing requirement.

Implications for investors

While the share swap ratio announced implies a premium of around 35 to LVB’s April 5 closing price, the upside in the stock hinges on a merger approval.

Both stocks — LVB and IBHF — has seen a strong rally in the past couple of months. IBHF shares have jumped around 35 percent, while those of LVB have risen 60 percent.

Uncertainty relating to approval will cause volatility in the stock prices of both LVB as well as IBHF. The merger ratio values LVB’s weak franchise at around Rs 125 per share which is trailing price-to-trailing book value (P/BV) of slightly over two times and significantly (more than 35 percent) above its April 5 market price of Rs 93. Investors in LVB should exercise caution and utilise the stock rally to exit the counter.

Even if we assume that the proposed merger sails through, the benefits of same will accrue only in the longer term. At its April 5 market price of Rs 900 per share, IBHF is trading around 2.2 times its estimated FY20 diluted book value.

Though the merger can improve the long-term growth prospects of IBHF, its return on equity (RoE) will fall to below 20 percent in the near term from above 25 percent. Hence, existing investors in IBHF should look to book gains and prospective investors should wait for more clarity from the regulator before investing in the stock.

[“source=moneycontrol”]